Imagine a small manufacturing business in India that has expanded rapidly over the past few years, but now finds itself struggling to manage multiple high-interest loans used for equipment purchases and operational expenses. How can such a business navigate its debt obligations effectively to ensure continued growth and financial stability? For many Micro, Small, and Medium Enterprises (MSMEs) facing similar challenges, the question arises: Should they opt for debt consolidation or debt restructuring as part of their debt resolution for MSMEs strategy?

Introduction to Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate and a single monthly payment. This strategy simplifies financial management by reducing the complexity of multiple payments and potentially lowering overall interest costs. For MSMEs, debt consolidation can streamline their financial obligations, making it easier to manage cash flow and focus on core business activities.

Introduction to Debt Restructuring

Debt restructuring, on the other hand, involves modifying the terms of existing debts to make them more manageable. This can include extending repayment periods, reducing interest rates, or even writing off portions of the debt. Debt restructuring is often used when MSMEs face financial distress and need to reorganize their debt obligations to avoid default or bankruptcy. It is a more comprehensive approach than consolidation, as it involves renegotiating with creditors to achieve sustainable repayment terms.

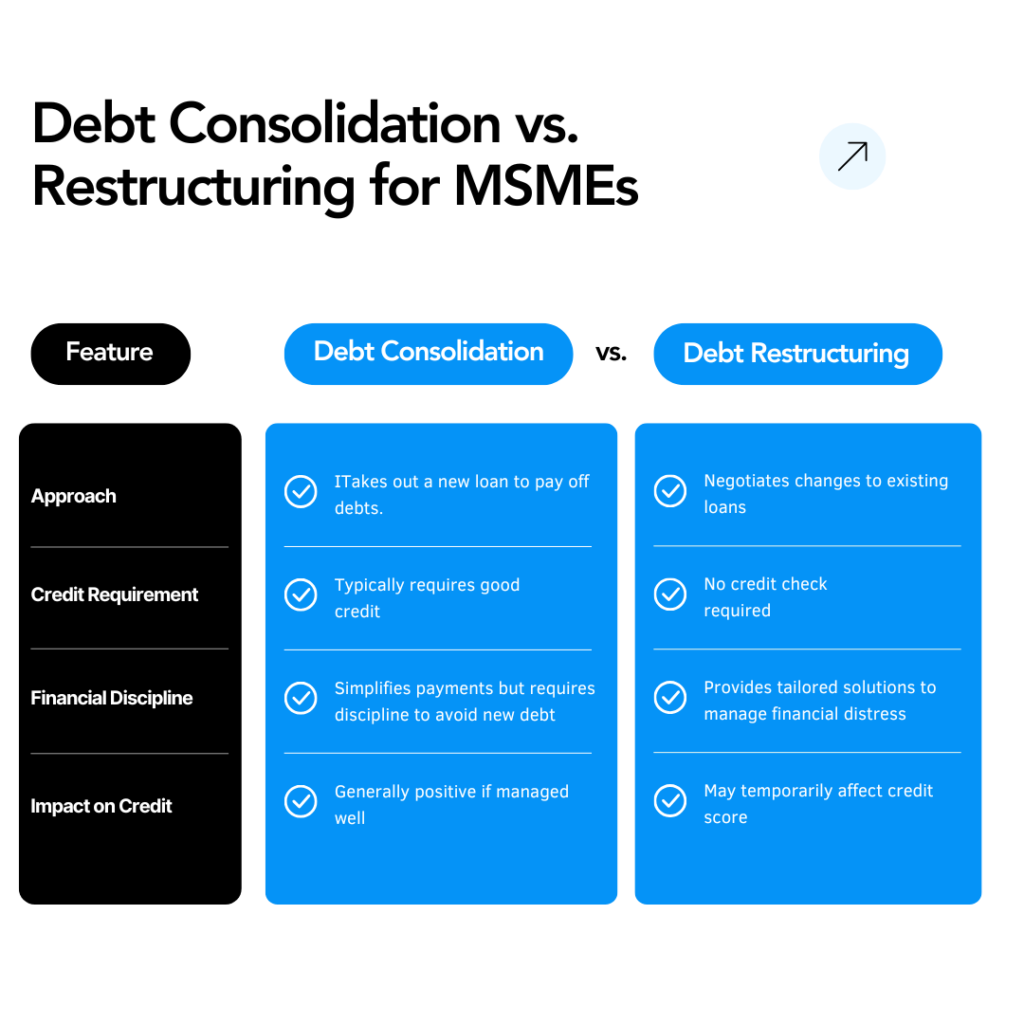

| Feature | Debt Consolidation | Debt Restructuring |

| Approach | Takes out a new loan to pay off debts | Negotiates changes to existing loans |

| Credit Requirement | Typically requires good credit | No credit check required |

| Financial Discipline | Simplifies payments but requires discipline to avoid new debt | Provides tailored solutions to manage financial distress |

| Impact on Credit | Generally positive if managed well | May temporarily affect credit score |

Benefits of Debt Consolidation for MSMEs

- Simplified Financial Management: Consolidating debts into a single loan simplifies accounting and reduces administrative burdens, allowing MSMEs to focus on strategic activities.

- Lower Interest Rates: Consolidation loans often offer lower interest rates compared to multiple high-interest debts, reducing overall interest expenses.

- Improved Cash Flow: By reducing the number of payments and potentially lowering monthly outlays, MSMEs can improve their cash flow management.

Benefits of Debt Restructuring for MSMEs

- Customized Solutions: Debt restructuring allows for tailored solutions based on the MSME’s specific financial situation, providing more flexibility than consolidation.

- Avoidance of Default: By renegotiating debt terms, MSMEs can avoid defaulting on loans, which can severely damage their credit score and business reputation.

- Long-term Viability: Restructuring can help MSMEs achieve long-term financial stability by aligning debt obligations with their cash flow capabilities.

Case Studies: Debt Consolidation and Restructuring for MSMEs

Case Study 1: Debt Consolidation

A small manufacturing MSME in India faced financial strain due to multiple high-interest loans used for equipment purchases and operational expenses. By consolidating these debts into a single loan with a lower interest rate, the company reduced its monthly payments and simplified its financial management. This allowed them to allocate more resources to production and marketing, leading to increased sales and profitability.

Case Study 2: Debt Restructuring

A medium-sized service-based MSME experienced financial difficulties due to unexpected market changes and high operational costs. The company opted for debt restructuring, negotiating with its creditors to extend repayment periods and reduce interest rates. This restructuring allowed the MSME to maintain its operations without defaulting on loans, preserving its creditworthiness and business relationships.

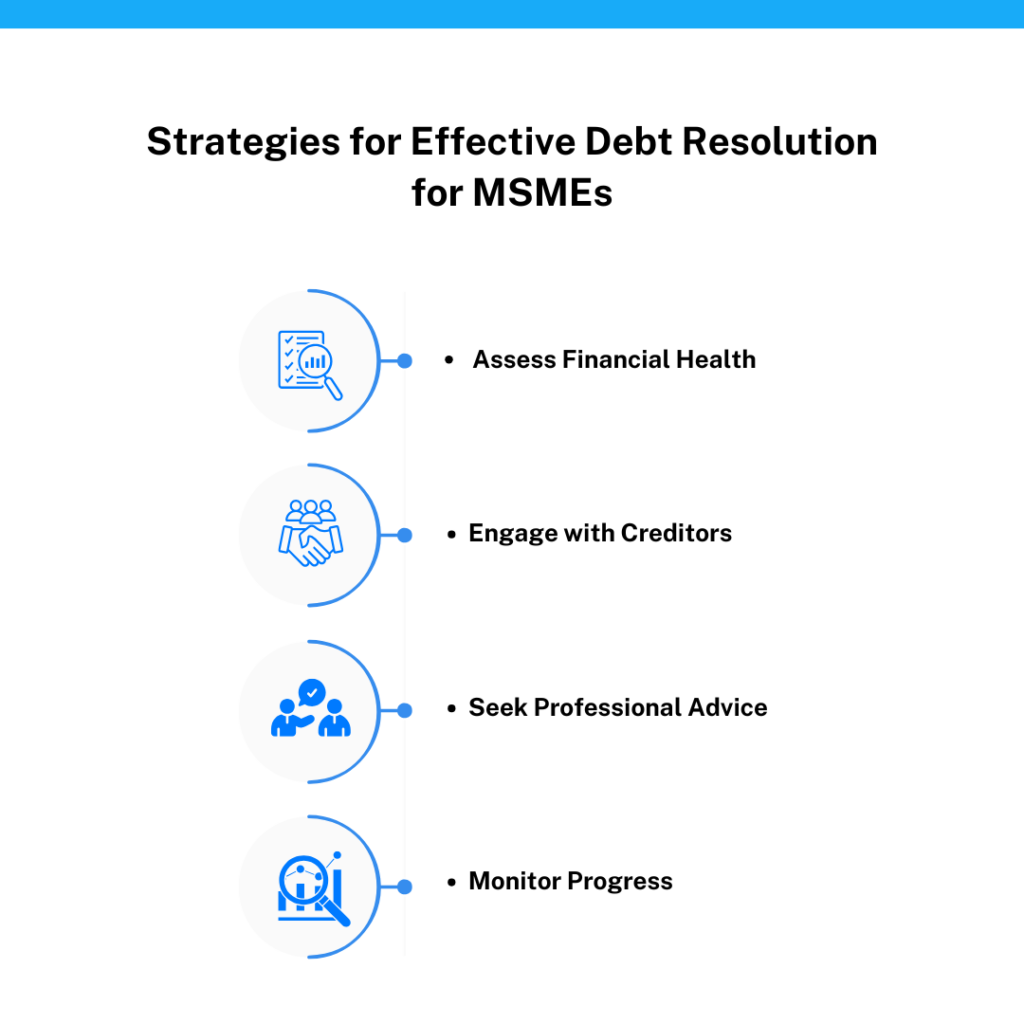

Strategies for Effective Debt Resolution for MSMEs

To achieve successful debt resolution for MSMEs, consider the following strategies:

- Assess Financial Health: Conduct a thorough financial analysis to determine whether debt consolidation or restructuring is more appropriate.

- Engage with Creditors: Communicate openly with creditors to negotiate favorable terms, whether through consolidation or restructuring.

- Seek Professional Advice: Consult financial advisors or restructuring specialists to ensure the chosen strategy aligns with long-term business goals.

- Monitor Progress: Regularly review financial performance to adjust debt management strategies as needed.

Impact of Digital Solutions on Debt Resolution for MSMEs

The use of digital debt resolution tools can significantly enhance both debt consolidation and restructuring processes for MSMEs. These tools offer advanced analytics for financial assessment, automated communication platforms for creditor engagement, and streamlined processes for managing multiple debts. By leveraging these technologies, MSMEs can optimize their debt resolution for MSMEs strategies, ensuring more efficient and effective financial management.

Conclusion

In conclusion, both debt consolidation and restructuring are valuable strategies for debt resolution for MSMEs. While consolidation simplifies financial obligations and reduces interest costs, restructuring provides a more tailored approach to managing debt in times of financial distress. By understanding the benefits and challenges of each method, MSMEs can choose the best approach for their specific situation, ensuring sustainable financial health and continued growth. As the Indian economy continues to evolve, effective debt resolution for MSMEs will remain crucial for these businesses to thrive and contribute positively to national economic development.

Debt resolution for MSMEs is not just about managing debt; it’s about ensuring the long-term viability of these critical economic contributors. By adopting the right strategies and leveraging digital solutions, MSMEs can navigate financial challenges effectively and maintain their role as drivers of economic growth.

References

- RBI. (2018). Policy on Management / Restructuring of MSME Stressed Assets. Retrieved from https://www.ucobank.com/policy-on-management

- Interlink Capital. (n.d.). Debt Recovery Services for MSME. Retrieved from https://interlinkcapital.in/debt-recovery-services.php

- Fleximize. (n.d.). 4 Steps to Debt Restructuring. Retrieved from https://fleximize.com/articles/001678/4-steps-to-debt-restructuring

- Finlender. (n.d.). Case Studies Successful Debt Restructuring Stories And Lessons. Retrieved from https://finlender.com/case-studies-successful-debt-restructuring-stories-and-lessons-learned/

- IDBI Bank. (n.d.). MSME Restructuring / Rehabilitation Policy. Retrieved from https://www.idbibank.in/restructuring-rehabilitation-policy.aspx

- MSME. (n.d.). What is debt restructuring of advances?. Retrieved from https://msme.gov.in/faqs/q34-what-debt-restructuring-advances

- LendingTree. (2025). Best Business Debt Consolidation Loans. Retrieved from https://www.lendingtree.com/debt-consolidation/consolidate-business-debt/

- Digital Alaska Business. (2021). Debt Restructuring: Strategies and Options. Retrieved from https://digital.akbizmag.com/issue/december-2021/debt-restructuring-strategies-and-options/